Why we're calm, despite market volatility

Published: 20/03/2020

The time for calm is when the urge to panic hits its peak

When others are panicking…

Checking and then re-checking our assumptions

How are markets being impacted?

| Index name | Peak to trough loss | 5% annual loss (expected) |

| S&P 500 | -29.41% | -24.02% |

| FTSE 500 | -30.92% | -24.31% |

| Euro Stoxx 50 | -36.41% | -31.56% |

So, while these losses are extreme, we expect losses of around this magnitude to arise in times of economic stress or in cases on market panic.

The move, also, in the FTSE 100 can be seen above – and these are big moves, especially over so short a period. For context, the last such moves were witnessed in H2 2018, but they happened over almost six months.

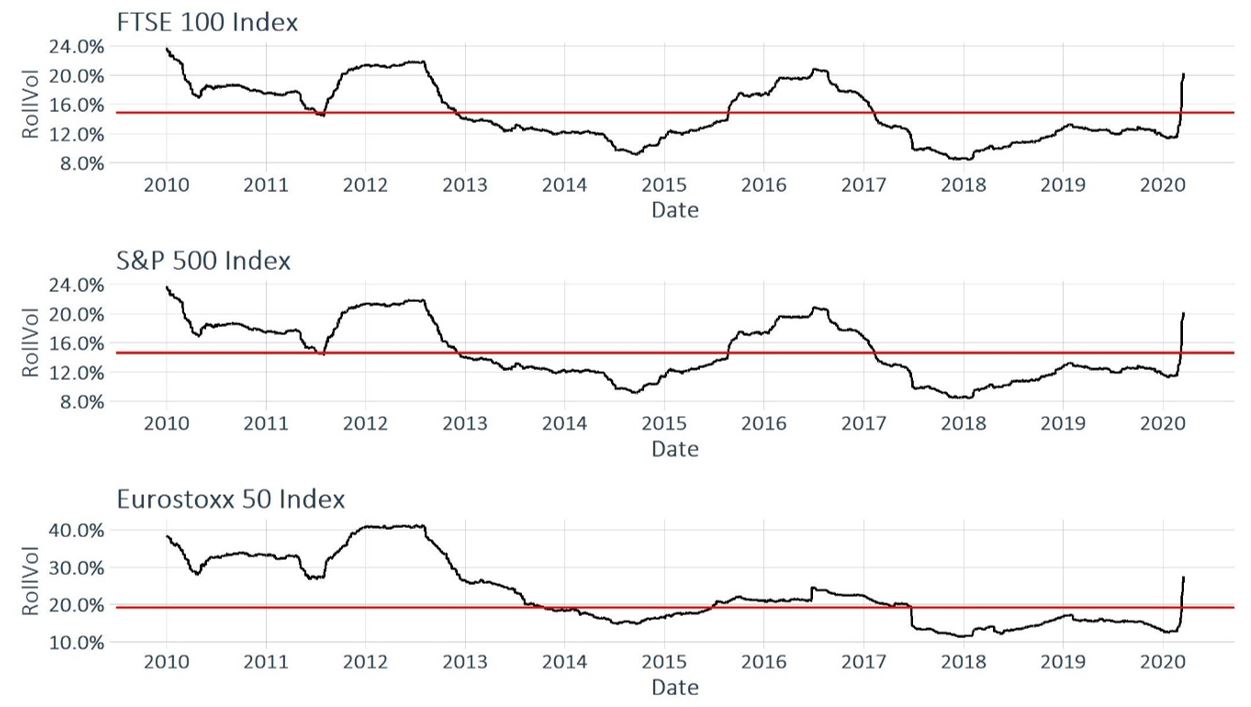

In terms of our modelling at Dynamic Planner, we remain quite confident. We use long-term models for our volatility estimation – and we have been criticised for our high expectations of volatility. The three graphs below show that even with these vehement moves, the ‘realised’ rolling volatility on these benchmark indices over the last 10 years is still some distance from highs experienced in the past 10 years (data as at 16 March 2020).

Rolling annualised volatility

Source: Dynamic Planner

Source: Dynamic PlannerVolatility is inevitable in a market cycle

From our perspective, advisers can be reassured that you can stand by the risk and the return you have led your clients to expect – and that unless there has been a change in the client’s circumstances, they should stay invested.

Remember – just because you could not see the risks, that didn’t mean that they weren’t there. And just because you haven’t had the returns today, that doesn’t mean you won’t get them tomorrow.

Important Information

This document was written by Dynamic Planner. VitalityInvest takes no responsibility for any inaccuracies or errors in the content of the document.

Nothing herein should be construed as an offer to enter into any contract, investment advice, a recommendation of any kind, a solicitation of clients, or an offer to invest in any particular fund or plan.

The value of investments and the income from them can go down as well as up and your client may get back less than they invest.

VitalityInvest is a trading name of Vitality Corporate Services Limited. Vitality Corporate Services Limited is authorised and regulated by the Financial Conduct Authority.

20/03/2020 | This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes. | VI NL 0014