Make sure your client and their loved one gets the perfect gift

Published: 06/12/2021

Choosing the right type of plan is vital in ensuring any inheritance tax liability is covered when a client makes a gift to another, but this can be confusing for financial advisers. Using two case studies, Vitality tax expert Kim Jarvis explains how it should be done.

What is the right cover? This is a question I’ve been asked countless times during my many years supporting financial advisers on trusts, taxation and estate planning. And it relates to the type of cover needed to insure the inheritance tax liability (IHT) that can arise when a client makes a gift to another person during their lifetime.

Well, the answer to that question is ‘it depends’. When an individual gifts property outright to another person, this is a potentially exempt transfer. If they survive for a period of seven years, the gift becomes exempt. However, should they die within seven years of making the gift it “fails” and the value of the gift needs to be included in their inheritance tax calculation.

So, what type of cover is required? To explore this, let me introduce you to Jasper and Conor. Both want to make outright gifts, but Jasper makes a gift of £300,000 and Conor makes a gift of £500,000.

What happens if they both die five years later?

Well, as neither survived seven years, the potential for the gift to be exempt fails and the gift becomes chargeable, so it needs to be included in their IHT calculations. All chargeable transfers made within seven years of death sit in chronological order and use up the nil rate band first.Let’s assume that both die with estates of £500,000, they have made no other gifts in the seven years before their deaths and they only have one nil rate band (£325,000). As neither had used their £3,000 annual exemption in the year the gift was made, or the previous year, £6,000 of both gifts are exempt (remember, if the annual exemption is not used in any tax year it can be carried forward but only for one year).

Jasper

After the £6,000 annual exemption, £294,000 of Jasper’s gift is chargeable and needs to be included in his inheritance tax calculation. The failed gift sits at the bottom and uses up the nil rate band first. But as this sits within the nil rate band there is no tax to pay on the failed gift. However, it means that there is only £31,000 (£325,000 - £294,000) nil rate band left to use against the rest of the estate. There is a common misconception that the value of the gift is tapered but remember that taper relief is a reduction in the tax payable - if there is no tax, there is no taper.As the full £294,000 sits within the inheritance tax calculation for seven years, unless the estate is exempt from IHT (for example, the estate passes to a spouse or civil partner or is left to charity), the loss of the nil rate band should be covered by a seven-year level term with a sum assured of £117,600 (£294,000 @ 40%). This ensures that the estate is compensated for the loss of the nil rate band.

Conor

After deducting the £6,000 annual exemption, the £494,000 gift will use up all the nil rate band leaving £169,000 liable to IHT. The estate then sits on top and will have no nil rate band.Firstly, let’s consider the cover required on the gift. We know on Conor’s death, within seven years, £169,000 of the gift would be subject to tax at 40% and as there would be tax to paid taper relief would be of benefit. Taper relief offers a gradual reduction in the amount of tax paid on a gift and, if Conor survives more than three years, the tax is gradually reduced by 20% each year.

‘Gift inter vivos’

This is when a ‘gift inter vivos’ policy or a series of level term policies ranging from three to seven years should be considered. The person liable to pay the tax on this failed gift is the person who received the gift, and they have two options – they can either take out a policy on the life of Conor or Conor can take out an own life policy and place it in trust for the absolute benefit of them. An absolute trust should be used as the tax liability will always rest with the recipient of the gift.A ‘gift inter vivos’ policy will have a term of seven years with the cover reducing by 20% each year from year three onwards. So, in our example the sum assured would start at £67,600 (£169,000 @ 40%) and then from year three onwards reduce by £13,520 (20% reduction each year) until expiry.

As not many companies offer gift inter vivos policies, an alternative is to take out five level term policies each with a sum assured of £13,520 (that is a fifth of the liability) with terms ranging from three to seven years.

“Ensuring that there is cover in place which enables the recipient of the gift to meet any tax liability gives peace of mind.”

- Kim Jarvis, Tax and Trusts Technical Consultant, Vitality

Using Jasper and Conor as examples, you can see that the type of cover required depends on the size of the gift as not all gifts made during lifetime will be liable to IHT. Seeking help from an expert can ensure that clients take out the right type of cover.

Wondering if a trust is a suitable option for your client?

Use our Trust flowchart

Where to next?

-

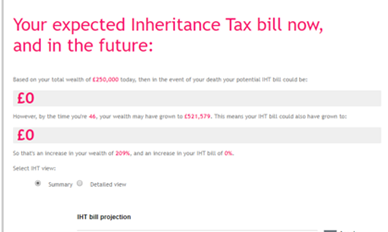

Inheritance Tax Calculator

Help your clients work out the size of the Inheritance Tax (IHT) bill they could leave behind when they die. Our Inheritance Tax Calculator can help them future proof their IHT planning.

-

The importance of trusts

The pandemic is driving demand for better quality protection advice so writing business into trust is more vital now than ever before, writes Vitality tax and trust expert Kim Jarvis.

-

Insights Hub

Our Insights Hub brings you our range of adviser content - from video series to articles & blogs.