How Vitality engagement can reduce risk of COVID death

Claims data from our parent company Discovery Group shows that engagement in the Vitality Programme could be a factor in saving lives during the pandemic – even for those with at least one underlying health condition as well as members over 60.

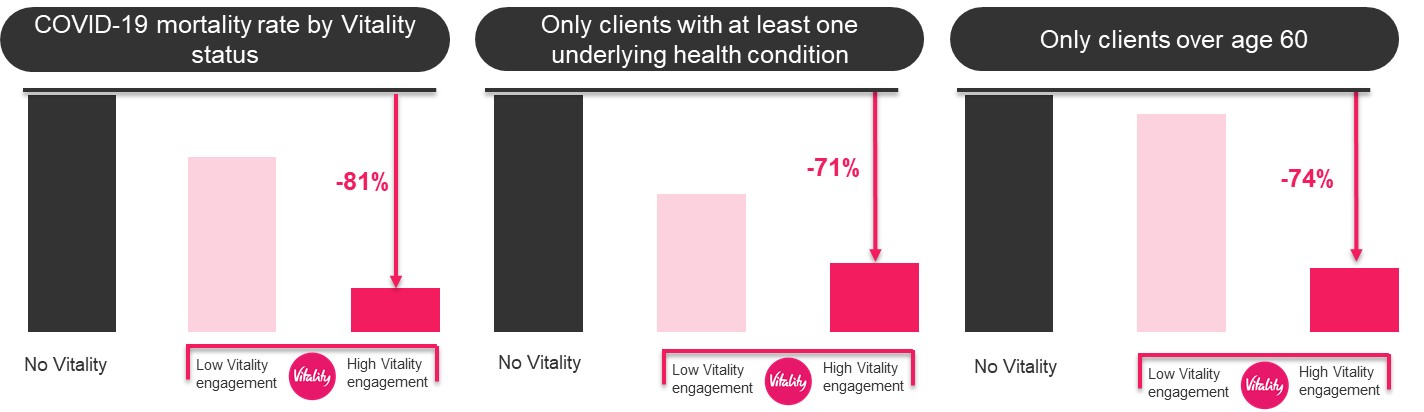

Planholders who engage with the behavioural changes of the Vitality Programme have a 81% lower risk of dying after contracting COVID-19 than those who do not participate, new data from our parent company Discovery Group has suggested.

The statistics, included as part of a recent special report1, also revealed that these improved outcomes are reflected by clients with at least one underlying health condition – there was 71% reduction in mortality risk for those who engage with Vitality. In addition, for members over the age of 60, a 74% reduction in mortality was found.

Taken from data involving thousands of South African members with a known coronavirus diagnosis (Discovery Group paid out £70m worth of life claims for COVID-19 in 2020), the findings reinforce the potentially life-saving impact of our Shared Value approach to life insurance, which incentivises members to address four main lifestyle risk factors.

In the UK, we have seen a 27% reduction in the risk of complications amongst Vitality members with high physical activity levels2.

Find out more about the Vitality Programme and how it can benefit your clients.

Sources:

1. Discovery South Africa Covid-19 Special report March 2021

2. Vitality member data and Covid cash claim analysis

Where to next?

-

Behavioural science and the road to healthier living

Why promoting better lifestyle choices can help save lives.

-

Why shared value insurance resonates more than ever

In the backdrop of this current climate, we examine how the shared value insurance model is now more relevant and important than ever.

-

Insights Hub

Our Insights Hub brings you our range of adviser content - from video series to articles & blogs.